What is a V5C logbook? Complete guide to your V5 document

If you are planning to buy a new or used car – or sell your car, you should be familiar with the V5C logbook.

This important document is used for transferring ownership of a vehicle, telling the DVLA that you’ve sold your car – and can also help you tax your car.

If you want to sell your car to webuyanycar, you'll need to bring your V5C logbook to your appointment. Many dealerships and private buyers will also request this document before buying your motor.

In this complete guide, we will define a V5C logbook and explain what it is used for. We’ll also clarify the differences between the old and new-style V5C formats. Finally, we’ll list the details covered within a V5C - and explain how to complete each section.

Get a free valuation

What is a V5C logbook?

A V5C logbook, also known as a V5, logbook or vehicle registration document registers your vehicle with the DVLA.

What is a V5C used for?

The V5C logbook records the registered keeper of the vehicle.

This is the person who registers and taxes the vehicle. Although a car’s registered keeper and its owner are often the same person, this is not always the case. Therefore, a V5C document is not considered to be proof of ownership.

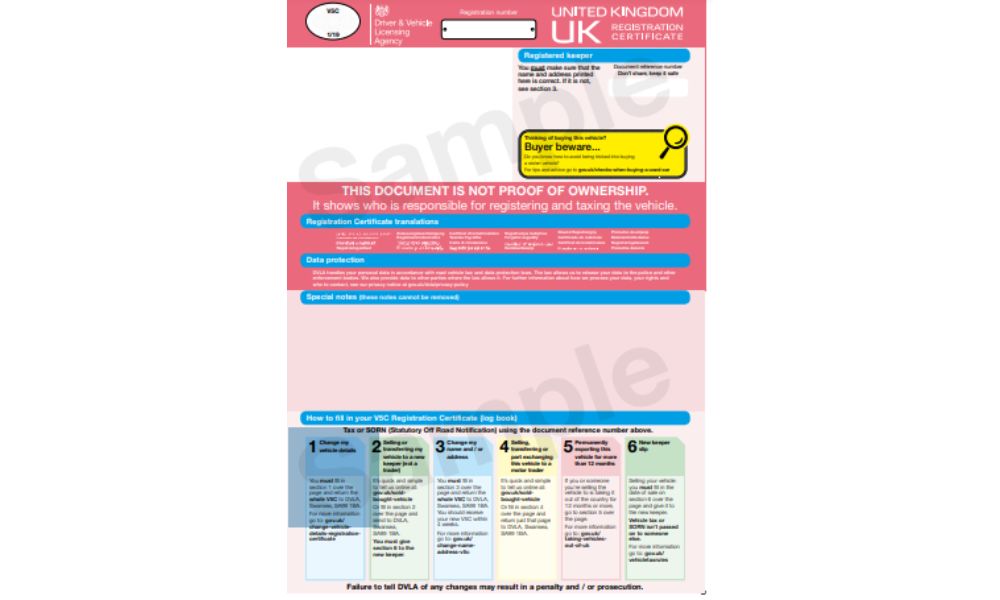

What does a V5C document look like?

On 15th April 2019, the DVLA amended the V5C document’s design with a view to improving the customer experience and easing the data digitisation process. The current V5C document design is shown below:

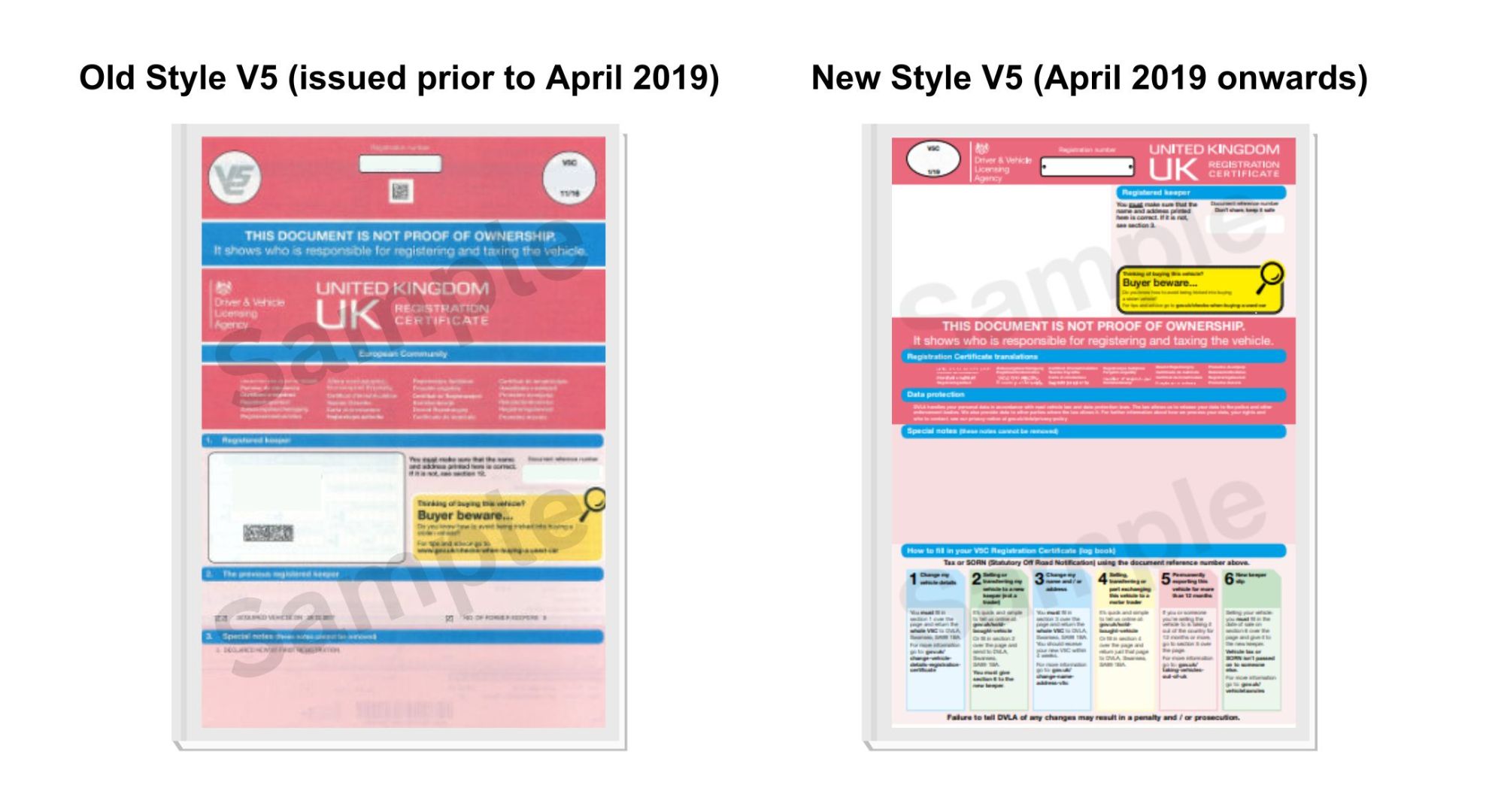

What are the differences between the new and old-style V5C documents?

The launch of the new-style V5C logbooks has created some confusion among motorists, as some popular online resources still reference the old-style documents. To make things clearer, here is a quick explainer on the differences between the two:

Front cover

- The document reference number is now positioned at the top of the page, along with the phrase, ‘Don’t share, keep it safe’.

- A new multi-coloured section with instructions on how to fill in your V5C logbook has been added near the bottom of the page.

- A new vehicle licencing compliance enforcement message has also been added.

- The registered keeper’s name and address are now placed near the top of the page.

- The date of acquisition is now placed just below the document reference number.

Internal changes

- The ‘Vehicle details’ section has been revised with extra space for you to add information about your car.

- The 'New keeper’ and ‘Change of name and address’ sections are now separate to avoid confusion.

- You can now supply contact details.

- A new ‘country of export’ field has been added for anyone who intends to export their car for more than 12 months.

- The name and address fields have been removed from the new keeper’s slip because previously, some drivers had inadvertently returned this to the DVLA, which left them unable to tax their car.

Additional changes

- To improve accuracy, data capture boxes have been added.

- Instructions have been simplified throughout.

- The signature boxes have been replaced with declarations in red text.

- A new dual language format has been introduced with English on one side and Welsh on the other.

- The V5CW (Welsh version) is serialised across three pages.

- The V5C is now serialised on the front cover and back page.

- The document reference number used to assign your registration to a car is now duplicated across all pages.

- The back page is now blank.

What information does the V5C logbook contain?

A V5C logbook contains the following information:

- The date of first registration.

- The current and previous registered keeper.

- The car’s details – including the make, model, colour, engine size, chassis, frame, VIN number - and car tax band.

- Forms to be completed to notify the DVLA that the registered keeper has changed or the car has been altered.

- There are also sections to be completed when the car is scrapped or permanently exported (for more than 12 months).

How to fill out a V5C

On the front cover of your V5C, you’ll see a panel with guidance for each of the six sections. This will inform you of which section you need to fill in. (If you don’t, this means you have an old-style V5C.)

-

Section 1: Changing your vehicle’s details

You should complete the bottom part of section 1 if you need to update your vehicle’s details. If the changes are not listed in section 1, add notes to the ‘Vehicle details’ section.

You may also need to submit additional evidence for the changes with your V5C. For more information, please visit the ‘What evidence to give’ guide on the DVLA website.

If any of the following have changed, post the whole V5C to: DVLA, Swansea, SA99 1DZ:

- Engine size (cc).

- Fuel type.

- Weight (for a goods vehicle).

- The number of seats (for a bus).

For any other changes, post your V5C to: DVLA, Swansea, SA99 1BA.

The DVLA will then contact you to:

- Confirm the change or tell you that an inspection is required.

- Tell you whether the change means you’ll have to pay more car tax.

It can take 2-4 weeks for your replacement logbook to arrive.

If you have not received it within 4 weeks, you should contact the DVLA. If you haven’t received your logbook after 6 weeks (and failed to notify the DVLA within this timeframe), you’ll have to pay £25 for a replacement.

-

Section 2: Selling or transferring my vehicle to a new keeper

If you are selling your car privately (or gifting it to someone), you need to notify the DVLA. The simplest way to do this is via the DVLA website.

Alternatively, you can notify the DVLA by detaching and completing Section 2 of the V5C logbook, then posting it to: DVLA, Swansea, SA99 1BA.

If you have a private number plate and wish to keep it, you’ll need to take it off your car before selling it. To learn more, visit our guide ‘How to retain a private number plate’. (If you are happy to sell the car with the private plate attached, no action is required).

-

Section 3: Change my name and/or address

You should complete this section if you have moved to a new address and/or changed your name. If you fail to inform the DVLA of these changes, you could incur a fine of £1,000.

What’s more, if you do not update your address in good time, important documents such as V11 reminders and DVLA car tax refunds will be sent to the wrong address.

If these details have changed (or the details in your current V5C are incorrect), complete Section 3 and send the whole V5C document by post to: DVLA, Swansea, SA99 1BA.

-

Section 4: Selling, transferring or part exchanging this vehicle to a motor dealer

Section 4 is only relevant if you have sold your car to a motor dealer such as:

- A car dealership.

- An auction house.

- A dismantler or salvage company.

- A finance or leasing company.

- An insurance provider.

- A car buying service (such as webuyanycar).

After the sale, you will retain Section 4 – and the motor dealer will retain the remainder of the V5C logbook. At this point, you must tell the DVLA that you have sold your car.

The easiest way to do this is via the DVLA website. However, if you do not receive an acknowledgment or a car tax refund, you should contact the DVLA, as you may still be liable.

Alternatively, you can notify the DVLA by completing Section 4 and sending the whole section by post to: DVLA, Swansea, SA99 1BA.

When submitting Section 4 by post, you should include the following information:

- The car’s registration number.

- The document reference number.

- The date of the sale.

- The car’s mileage (at the point of sale).

- The name, address, postcode and VAT number of the motor trader.

-

Section 5: Permanently exporting a vehicle (for more than 12 months)

You should complete Section 5 if you are planning to export your vehicle for more than 12 months. (This is considered a ‘permanent export’.)

Complete this section with the following information:

- Your car’s registration number.

- The document reference number.

- The date of export.

- The country you plan to export your car to.

Detach Section 5 by tearing along the red perforated line and post it to: DVLA, Swansea, SA99 1BA.

-

Section 6: New keeper slip

Complete this section with the following information when selling your car (or gifting it) to someone else:

- Your car’s registration number.

- The document reference number. (The new keeper can use this to tax the car online.)

- The date of sale or transfer.

- The car’s make, model, colour, engine size and suspension type.

- The car’s tax class.

- The number of seats.

If you are the new keeper of a car and you want to tax it, you can use to the reference number on the new keeper’s slip to tax it whilst waiting for the new logbook to arrive.

Remember, all cars must be insured and taxed – or declared SORN. (You may incur a fine if your car does not meet these criteria.)

You should not send this section to the DVLA. (They will not send you a new V5C logbook.)

How do I complete a V5C document when buying a used car?

The seller will register the vehicle to you either online or by post, fill in the green new keeper slip and give this to you. The DVLA will then send out a new V5C to you in 3-5 days, and the seller should destroy the old V5C.

What should I do if I’ve lost my V5C?

If you’ve lost your V5C, you don’t need to worry - you can request a replacement via the DVLA website.

However, if you need to amend any of the details on your V5C, you will need to submit a V62 form to the DVLA by post.

How to order a replacement V5C document

Simply order the duplicate V5C online or over the telephone and it will be posted to the address the DVLA has on record.

You can also tax your car without a V5.

How to change your details on your V5C

You can either fill in the relevant paper section and post it or complete a change online.

How to change the address on your V5C online

Simply visit the gov.uk website to change your address.

How to change your V5C by post

Fill in the relevant section and post it to the following address:

DVLA

Swansea

SA99 1DD

How to change your name on your V5C

As above, fill in the relevant section and post it, or complete a change online.

When should I update my V5C?

You should update your V5C if you have changed your name, address - or vehicle.

Notifying the DVLA when your car has been written off

You should contact the DVLA with the following information to inform them that your vehicle has been written off:

- Your insurance company’s name and postcode (write this information in the ‘provide transfer details’ section).

- Your vehicle registration number.

- The 11-digit reference number from the yellow ‘sell, transfer or part-exchange your vehicle to the motor trade’ section of the V5C.

Can you sell a car without a V5C?

You can't sell your car to webuyanycar without a V5C logbook.

It may be possible to sell your car without a V5C logbook. However, even if you can find a private buyer that's happy to purchase the vehicle, it's likely that your car valuation will be severely reduced.

Many trade and private buyers will be deterred if a car's V5C logbook is missing due to concerns that the car could be stolen.

Therefore, if this document is missing, we recommend applying for a duplicate logbook via the DVLA website – or by submitting a V62 form to the DVLA by post (if any of your details have changed).

Frequently Asked Questions

You can find your V5C (or vehicle registration) number at the top of the document. This combination of numbers and letters is unique to each vehicle.

No, a V5C logbook is not proof of ownership. (This is stated on the document itself.)

The registered keeper and the owner are not necessarily the same person.

If you have bought a new car, you should receive the V5C logbook within 4 weeks of the vehicle being registered.

If you submitted a V62 form by post, you should receive your logbook within 4 weeks.

If you have bought a used vehicle (and the seller registered it to you online) - or requested a replacement V5C, you should receive your logbook within 3-5 days.

Download and fill in the V62 form. Send it to the DVLA with the green ‘new keeper’ slip you were given when you bought the vehicle. (You won’t have to pay a fee in this instance.)

Apply online and you should receive it at the registered keeper’s address within 3-5 days.

It is often possible to tax your car without a V5C logbook. You can find the reference number you need on your V11 reminder document. (The DVLA should send you this after the 5th day of the month before your car tax is due.)