If you’re preparing to make the switch to a new motor, you may be wondering if you need to tell the DVLA after you sell your car.

The answer is yes, you have a legal responsibility to do so. The DVLA is responsible for registering driving licences, MOT testing, and roadside enforcement in England, Scotland, and Wales - and they rely on input from drivers to keep their records up to date.

If a car you no longer own is still registered to you on the DVLA database, its new owner could accrue parking and speeding fines – and even driving licence penalty points in your name. Therefore, you must notify the DVLA at the point of sale to transfer ownership of the vehicle.

Quick links:

Get a free valuation

How do I tell the DVLA I’ve sold my car?

-

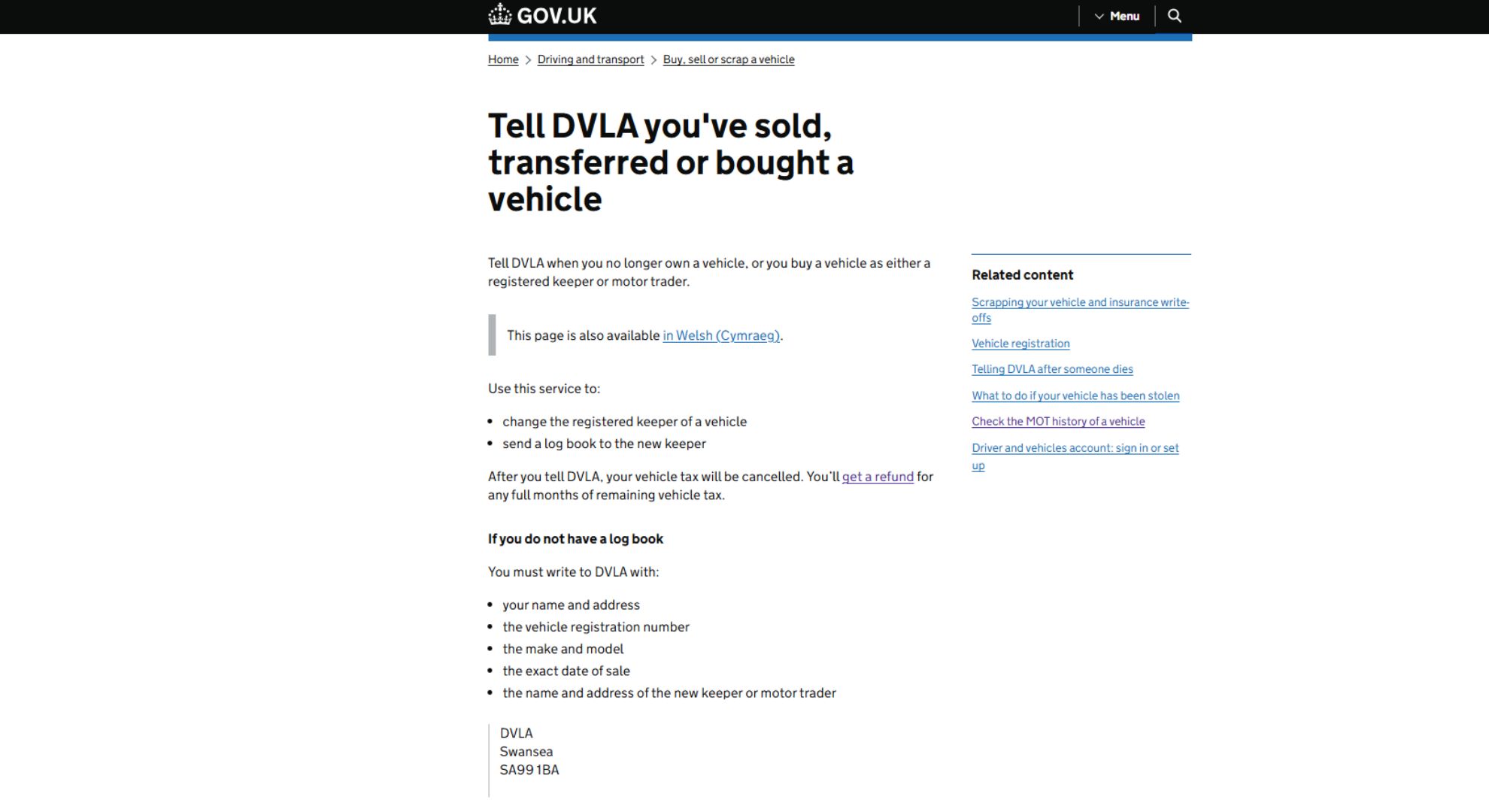

Online

Using DVLA's online service is the quickest and easiest way to let them know that you’ve sold your car to a person, business, or trader.

Make sure you have the 11-digit document reference number from your V5C logbook and the full name of the new keeper to hand, then follow the instructions on screen.

If you’ve given them permission to do so, the trader can also use this service to tell the DVLA that you’ve sold your vehicle to them.

The DVLA’s online service is available from 7am to 7pm every day.

Updating online is much more simple. You can follow the instructions on the UK Government website.

-

By post

You can also tell the DVLA you’ve sold your car by post.

If you’re selling to a motor trader, scrapping, or part-exchanging your car

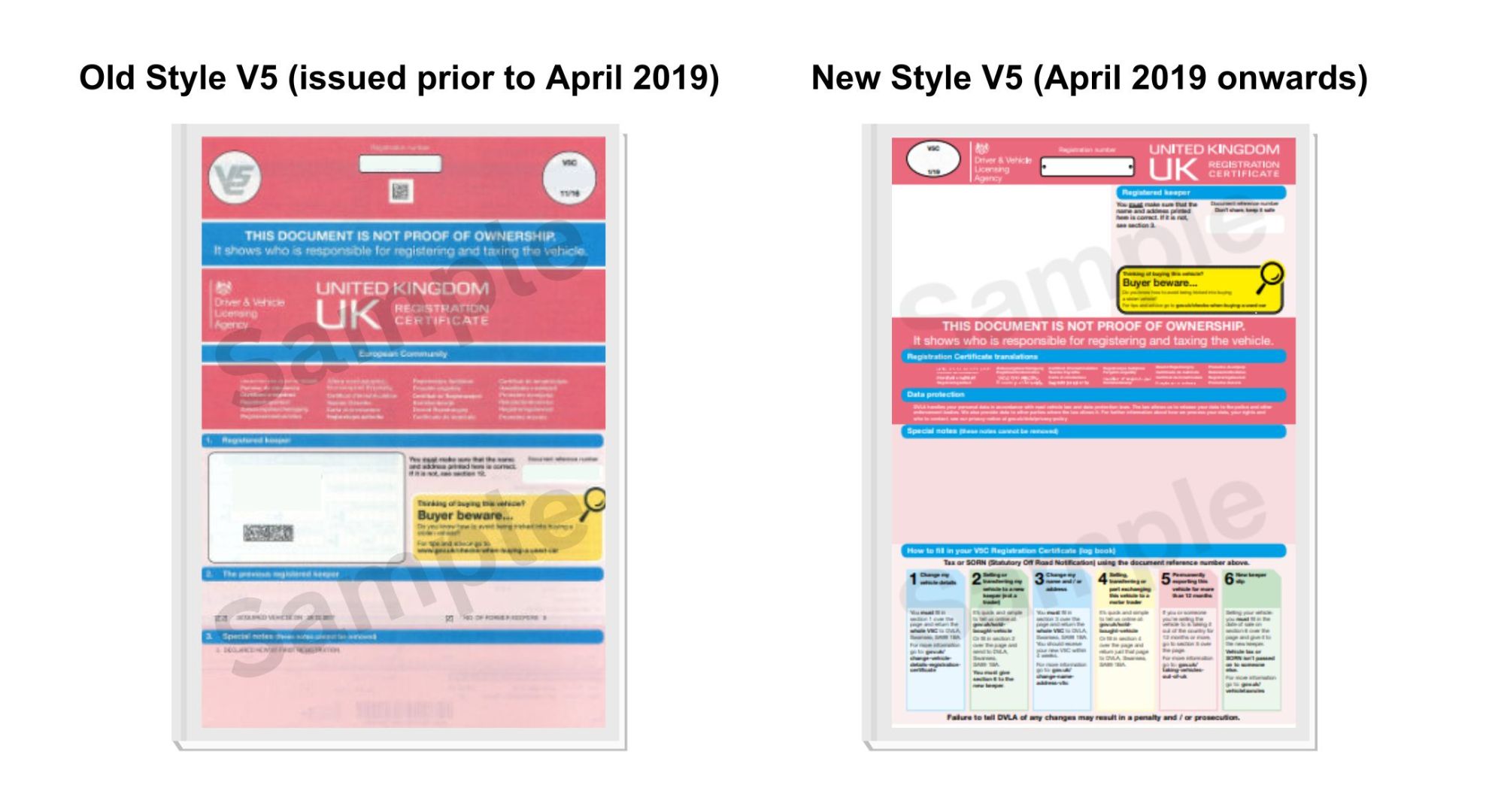

For the latest V5C logbook format (issued from April 2019 onwards).

- Complete section 2 of your V5C logbook.

- Write the date of the sale in section 6 and give the new keeper slip to the buyer.

- Post the remainder of the V5C logbook to the following address: DVLA, Swansea, SA99 1BA.

For old style V5C logbooks (issued prior to April 2019)

- Complete section 6 of your V5C logbook.

- You and the new keeper must sign and date the declaration in section 8.

- Complete section 10, also known as the ‘new keeper supplement’ or V5C/2. Detach this section and give it to the new keeper, as they’ll need it to tax the vehicle.

- Detach sections 1-8 of your V5C logbook and post the paperwork to: DVLA, Swansea, SA99 1BA.

If you’re selling to a motor trader, scrapping, or part-exchanging your car

For the latest V5C logbook (issued from April 2019 onwards)

- Detach section 4 and give the rest of the V5C logbook to the dealer/trader.

- Complete section 4 and post it to: DVLA, Swansea, SA99 1BD.

For old style V5C logbooks (issued prior to April 2019)

- Fill in section 9 of your V5C logbook. Detach this section and post it to: DVLA, Swansea, SA99 1BD.

- Give the rest of your V5C logbook to the motor trader.

- It’s your responsibility to ensure section 9 is sent to the DVLA, even if the trader offers to do so on your behalf. If you gave the motor trader the whole V5C at the point of sale, you should send a signed letter to the DVLA confirming the sale.

Front cover for both versions of aV5C logbook.

I’ve sold my car but lost my V5C logbook. How do I tell the DVLA?

If you sold your car without a V5C logbook, given it to the buyer/trader, or misplaced it after the sale, you can’t notify the DVLA online. Instead, you’ll need to write a letter with the following information:

- Your name and address.

- Your old car’s registration number.

- The make and model.

- The exact date it was sold.

- The name and address of the new keeper or motor trader.

Post the letter to: DVLA, Swansea, SA99 1BA.

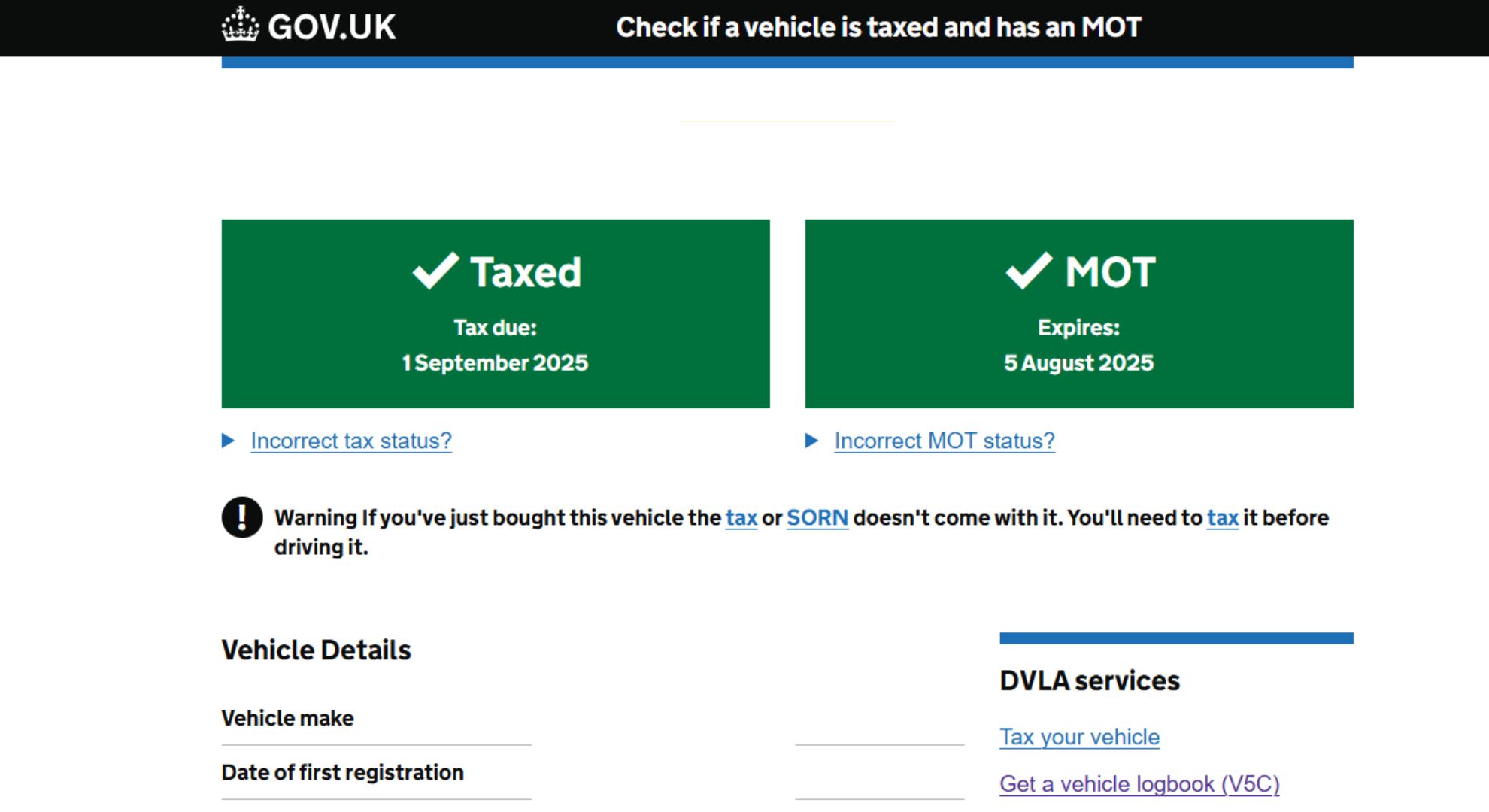

How to get car information from the DVLA

The information the DVLA holds can be invaluable when you’re selling or buying a used car, particularly if the V5C logbook is missing.

You can use the vehicle enquiry service on the DVLA website to find key details about any UK-registered vehicle, including its:

- Make, model, colour and engine size.

- Year of manufacture and the date it was first registered.

- MOT and road tax status – and the dates of expiry for its MOT certificate and road tax.

You can also use our MOT check tool or the DVLA website to view a vehicle’s full MOT history (from 2005 onwards), including recorded mileages, test locations, whether it passed or failed each test, and any advisories highlighted during MOT tests.

Finally, you can use the DVLA website to determine whether a vehicle is subject to recall.

You can check important car information online through the DVLA website.

Do I need to tell the DVLA after scrapping my car?

Yes, it’s your responsibility to notify the DVLA when you’ve scrapped your car. You can do this quickly, via the DVLA website. Make sure you have the following details available:

- The vehicle’s registration number.

- The 11-digit reference number from the V5C logbook.

- The name and address of the scrapyard or authorised treatment facility (ATF) where the vehicle was scrapped.

If you can’t notify the DVLA online, you’ll need to detach and fill out one of the following sections in your V5C logbook:

- Section 9 (if your logbook was issued from April 2019).

- Section 4 (if your logbook was issued prior to April 2019).

If you don’t have a V5C logbook for the vehicle, write a letter to the DVLA explaining you’ve scrapped the car with the following information:

- Your full name and address.

- The vehicle’s make, model, and registration.

- The name, address, and VAT number of the scrap dealer.

Post the relevant section or letter to: DVLA, Swansea, SA99 1BA.

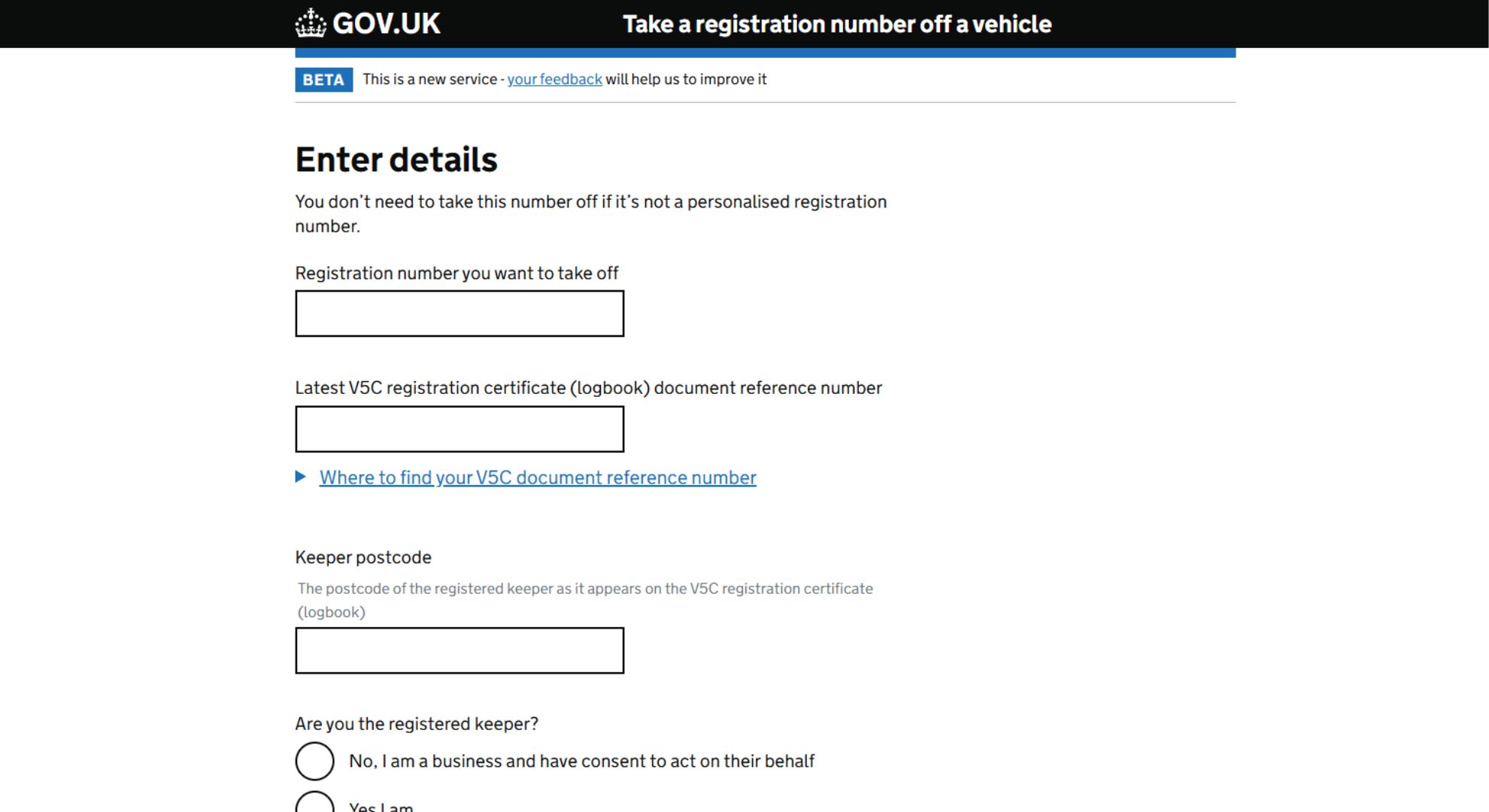

Informing the DVLA that you’re keeping your registration

You can apply to retain your personalised number plate via the DVLA website – or by submitting a V317 form to the DVLA, with the V5C logbook, new keeper slip, or a completed V62 form.

Visit our step-by-step guide to keeping your private number plate for more detailed guidance.

If you want to keep your registration, your vehicle must:

- Be registered with the DVLA.

- Be capable of starting and moving under its own power.

- Be the type of vehicle that needs an MOT or Heavy Goods Vehicle (HGV) certificate.

- Be available for inspection by the DVLA if necessary.

- Have been either taxed or subject to a Statutory Off Road Notification (SORN) continuously for the last five years. You will need to tax your vehicle if it has been declared SORN for over five years – and the DVLA may also ask to inspect it before approving your request.

Here are a few more important considerations when it comes to retaining number plates:

- It costs £80 to put a private plate on retention – and an additional £80 to transfer it to another vehicle. So, a vehicle-to-vehicle plate transfer will cost a total of £160.

- If you want to sell your car but retain your private plate, you’ll need to take it off your car before you sell it. Otherwise, the registration will transfer to the new owner at the point of sale.

- If you plan to scrap your car with a private plate, you must remove the plate from the vehicle first – otherwise, you’ll lose the rights to the registration.

- You cannot transfer number plates with a ‘Q’ or ‘QNI’ prefix.

- If your car is written off and you want to retain your private plate, you must notify your insurer before your car is scrapped, otherwise you’ll lose the rights to the plate.

You can simply apply to retain your personalised registration plate on the DVLA website.

What if I sold my car abroad?

The guidance above still applies if you are transferring to a dealer and/or a new keeper in the UK.

However, you must follow a different process to notify the DVLA if the person you’re transferring to lives overseas.

In this case, you can only notify the DVLA by post:

- You’ll need to complete the ‘permanent export’ section of your V5C logbook (section 5).

- Once completed, detach this section, and post it, with a letter including the buyer’s name and address to: DVLA, Swansea, SA99 1BD.

- Give the remainder of the V5C logbook to the next owner, so they can register the car in their country of residence.

Does car tax get cancelled automatically?

Yes, once you notify the DVLA that you’ve sold your car, your car tax will be cancelled.

If you have any full months’ car tax cover remaining when you cancel, a refund cheque will be sent to the name and address referenced in the V5C logbook.

Will I automatically receive an insurance refund when I tell the DVLA I sold my car?

No, you’ll need to contact your insurance provider separately to cancel your car insurance. You may be eligible for a refund if you chose to pay annually and still have outstanding cover on your policy.

What happens if I fail to tell the DVLA I’ve sold my car?

If you fail to notify the DVLA when you sell your car, you could receive a fine of up to £1,000. You may also be held liable for:

- Speeding tickets and parking fines.

- Road tax penalties (e.g. if your existing road tax cover expires and the new owner fails to renew it).

- Penalties and fines from traffic offences committed by the new owner.

If you’ve sold your car but haven’t yet notified the DVLA, you should do so online or by post at the earliest opportunity.

What if I failed to collect the buyer’s full details?

Posters in online automotive communities have raised difficulties updating the DVLA after they sold their car without collecting all the necessary details from the buyer.

It’s your responsibility to record the buyer’s full name and address when selling your car. If you don’t have this information, you’re in a tricky position.

You can’t notify the DVLA through the usual channels without the new owner’s details – and you risk incurring a fine of up to £1,000 for failing to do so.

If the new owner doesn’t send the new keeper slip to the DVLA, you could also be liable for any penalties or fines they incur.

If you find yourself in this situation, contact the DVLA and provide them with as much information about the sale as possible. Unfortunately, the onus is on you to prove that you did not own the car at the time any offences were committed.

Do I need to tell the DVLA after selling to webuyanycar?

No, if you sell your car to webuyanycar, we’ll notify the DVLA on your behalf. If you had any full months’ outstanding road tax cover, the DVLA will send a refund to the address in your V5C logbook.