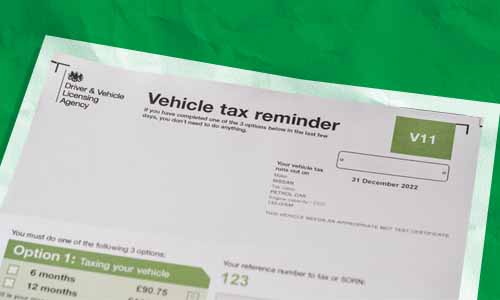

A V11 reminder is a document sent out by the DVLA to notify your that your car tax is due for renewal. You can use the reference number on your V11 to renew your car tax, or make a SORN (Statutory Off-road Notification) for your car, if you intend to take it off the road.

Read our guide to find out exactly what a V11 reminder contains and what to do when you get one.

Please note: If you’re unsure when your road tax is due, you can find out any time using our free car tax check tool. Simply enter your reg number to get started.

Get a free valuation

What is a V11 form?

A V11 form gives you options to tax your car or make a SORN. It consists of three sections:

-

This section is pre-filled with the car owner’s name and address, vehicle registration number and road tax expiry date. Check that these details are all correct and contact the DVLA if not.

-

In this section, you’ll need to specify why you’re using the form. You can pay your road tax, SORN your vehicle or tell the DVLA that you’ve sold your car. (Only select one option.)

-

This section explains how you can tax your car by phone, online or in person at a Post Office.

When will I receive a V11?

You should receive a V11 after the 5th day of the month before you’re due to renew your road tax. For example, if your car tax is due for renewal on November 11th, you should receive your V11 any time after October 5th.

Should I wait until I receive my V11 before renewing my road tax?

It’s important to renew your car tax as soon as possible. Remember, a V11 is your first and only reminder, so don’t wait for it to arrive before paying. If you’re caught driving without tax, you could face a fine between £80 and £1,000. The DVLA also has the power to clamp your car until you’ve paid your road tax fine in full.

Losing or not receiving your V11 won’t be accepted as an excuse.

Choosing to pay your road tax by Direct Debit is a good option, as this will ensure there are no payment gaps that could put you at risk.

Important: Don’t forget to cancel your road tax Direct Debit after you sell your car, as any outstanding road tax cover will not be transferred to the next owner.

When notifying the DVLA that you have sold your car, you should instruct them to cancel your direct debit. The DVLA will then issue you with a refund cheque, if you had any full months’ outstanding cover.

Can I tax my car in advance?

You can tax your car via the DVLA website up to two months in advance. It’s worth noting that you’re only supposed to do this if you’ll be away from home and unable to renew your tax when it runs out.

You’ll need to submit the following:

-

Your V5C logbook.

-

A letter stating the reason you’re applying in advance.

-

A completed road tax application (V10 form).

-

An MOT or Goods Vehicle Testing (GVT) certification, if applicable (must be valid when the tax starts).

-

A cheque, postal order, or banker’s draft made payable to ‘DVLA Swansea’ for the total cost of your road tax.

Post all the above to: DVLA, Swansea, SA99 1DZ.

Please note: You can print a replacement MOT certificate at home for free, or obtain a copy from the relevant garage for a fee of up to £10.

Can I get a V11 online?

No, you can’t obtain a V11 online as it’s classed as a courtesy reminder rather than an essential document.

Can I tax my car without a V11?

If you don’t have a V11 form, you can renew your road tax with any of the following documents:

-

Your V5C logbook (using the 11-digit reference number).

-

The green ‘new keeper’ slip, if you have just bought the car and don’t yet have a V5C in your name. (Use the 12-digit reference number on the slip.)

Can I SORN my car without a V11?

Yes, you can also use a V890 form, apply online, or over the phone.

However, you will need your V5C logbook, whichever method you choose. If this document is missing, you’ll have to obtain a replacement before you can make a SORN for your car.

In this case, you should submit a V890 form, along with a V62 form (to request a replacement logbook) and a £25 cheque or postal order made payable to ‘DVLA, Swansea’.

How do I tax or SORN my car?

-

Online

-

Visit the ‘Vehicle Tax’ section of the DVLA website.

-

Enter the 16-digit reference number from your V11 form. Alternatively, you can use the reference number from your V5C logbook, or ‘new keeper’ slip.

-

Follow the instructions to confirm your details and make payment. You’ll need to have your debit or credit card to hand, or your bank details, if you wish to set up a Direct Debit.

-

-

By phone

-

Call the DVLA using the number provided on your V11 form.

-

State the 16-digit reference number from your V11 form. You can also use your V5C logbook. (State the 11-digit reference number if using your V5C.)

-

Follow the instructions given by the automated service or customer service agent - and make sure you have your credit/debit card or bank details to hand.

-

-

At a Post Office

-

Use the Post Office’s Branch Finder tool to find the nearest branch that offers a vehicle tax service. (This is not available at all Post Office branches.)

-

Take your V11 form to the counter. You can also use your V5C logbook or new keeper’s slip.

-

Pay with a credit or debit card, or by setting up a Direct Debit.

-

Frequently Asked Questions

Your 16-digit reference number can be found at the top of your V11 form.

Yes, the DVLA still issues V11 reminders. Make sure the DVLA has your correct address to avoid missing your letter.

No, you won’t get a reminder, as your payments will be taken automatically.

Yes, you can opt out of receiving V11 reminders by post via the DVLA website using your ‘Drivers and vehicles’ account. You can also choose to receive road tax alerts via text and/or email, if you pay road tax every 6 or 12 months.