Sell your car with outstanding finance

We can take the hassle out of selling your car, even when you have outstanding finance. Get started by entering your registration below to see how much your car is worth.

Can you sell a car on finance?

Yes, you can sell a vehicle that is financed, if it was bought through a hire purchase (HP) or personal contract purchase (PCP) agreement.

It’s important to note that if there is outstanding finance on the vehicle, this must be settled before the car is sold.

If you choose to sell to webuyanycar, we can settle any outstanding finance on your behalf. You’ll just need to obtain an up-to-date settlement letter and bring this to your appointment.

What happens when you sell your car on finance?

If you are financing a car through a HP or PCP agreement, it will remain the property of the finance company until the money you owe has been paid in full.

Therefore, you technically do not have the right to sell it. However, in practice, it is possible to sell a car with outstanding finance.

Many leading car dealers and car buying services can settle finance on a car that is still under contract. This will enable you to exit your current contract, leaving you free to sell your car.

How do I sell a financed car? (step-by-step)

In this section, we’ll break down the process for selling a financed vehicle. It’s important to note that this guidance only applies to cars bought with a HP or PCP agreement.

If you’re financing a car through a personal contract hire (PCH) agreement, you’re merely leasing it, meaning it’s not yours to sell.

-

Step 1 - Get a settlement letter

Contact your finance provider and tell them you want to sell the car. You’ll need to ask their permission because until the loan has been paid in full, they are still the legal owner of the vehicle.

-

Step 2 - Request a settlement figure

You’ll also need to request a ‘settlement figure’ from the car finance company. This sum will include your balance (i.e. what you currently owe on your car finance plan), in addition to any administrative and early settlement charges.

The lender is legally required to post a settlement figure within 12 days of your request, but it won’t usually take this long. Settlement figures are typically valid for 10 days, although this can vary, so check the finance company’s letter for the expiry date.

-

Step 3 - Get a valuation

By getting an accurate valuation for your car, you’ll have a clear view of what is (and isn’t) a good price. This should help you to navigate the selling process with confidence.

Unsure what your car is worth? Our free car valuation tool can provide you with a quote in less than 30 seconds.

-

Step 4 - Prepare your car

Once you have permission to sell the car, along with the finance settlement figure, you can start preparing it for resale. To maximise resale value, clean the car thoroughly inside and out – and invest in any minor mechanical and cosmetic fixes.

Make sure that key documents such as the V5C logbook and service history are available – along with extras such as the wheel locking nut and spare key. If any of these items are missing, your car’s value will be reduced.

-

Step 5 - Settle the outstanding finance

Many car dealers (including webuyanycar) can settle any outstanding finance for you, although in some cases, you’ll need to pay the balance of the loan to the lender yourself. It is not possible to sell your financed car privately until the outstanding finance has been settled.

If you need to settle the outstanding finance yourself, you should be able to do so over the phone, or via your online banking app. It’s important to clarify the processes for the loan provider – and your chosen buyer.

-

Step 6 - Sell your financed car

Once the outstanding finance on your car has been settled, you’ll have the right to sell it. Make sure you have all the accessories and paperwork you need – and get ready to sell.

-

Step 7 - Receive the surplus

If you sold your car for more than the sum of the outstanding finance, you’ll receive the surplus amount from the buyer after the point of sale. You can put this cash towards a new car if you choose to.

Looking for more information on car finance?

If you want to sell your car, but are unsure whether this is possible due to outstanding finance, our complete guide is here to answer all your burning questions.

Quick links:

- Who owns a financed car?

- Equity explained

- Sell a car with HP finance

- Sell a car with PCP finance

- Sell a car with PCH finance

- PCP vs HP vs loan

- Selling a car bought on loan

- Selling privately with finance

- Part-exchanging a financed car

- Scrapping a financed car

- What affects valuation?

- Selling your car to webuyanycar

Who owns a financed car?

The lender will remain the legal owner of a financed car until the balance of the loan has been paid in full.

You can pay off the loan by making all the regular payments, or by settling the outstanding finance before the end of the term.

Positive and negative equity explained

Positive equity

When the current resale value of your car exceeds the amount you owe on it, you are in positive equity. For example, if your car is currently worth £15,000, but you owe £7,000 on your finance plan, you have £8,000 of positive equity.

When you are in positive equity, you can settle the outstanding finance and get some cash back when you sell your car.

Negative equity

When your car is worth less than the outstanding balance of your finance plan, you’re in negative equity.

If your car’s current resale value is £2,000 - but you have £3,000 left to pay, this is classed as negative equity.

To settle the outstanding finance in this case, you’ll have to make up the shortfall between your car’s value and the loan balance.

How to calculate your financed car’s equity

Subtract the outstanding balance from your car’s current market value. You can find your car’s market value using our free car valuation tool. To ensure an accurate valuation, remember to provide key details about your car’s mileage, damage, and history.

If your car’s value exceeds the outstanding balance, you’re in positive equity.

However, if its value is lower than the outstanding balance, you’re in negative equity.

Tips for avoiding negative equity

-

Choose a car that holds its value well - Some cars hold their value better than others, so choosing a model with greater resistance to depreciation can protect more of your investment.

-

Put down a large deposit - If you have the funds available, consider paying off a large chunk of the car’s value with your deposit. By putting down a larger deposit, you’ll borrow less money, which often means you’ll be charged less interest, so you’ll pay less overall.

-

Look after the car - If you take good care of your car, this will preserve more of its value, helping you to avoid negative equity. Stay on top of your servicing and maintenance schedule, proactively address any faults – and keep your car clean inside and out.

-

Avoid modifications that could reduce value - Certain modifications can reduce value, which will hit you in the pocket if you’re financing a car. You should avoid brash decorative changes, poorly executed and illegal modifications. It’s worth mentioning that some modification (e.g. upgrading your infotainment system) can increase value, providing the work is carried out professionally. Our guide to selling modified cars covers this subject in more detail.

-

Minimise your mileage - Retaining a below-average mileage for your financed car will help it retain more value. If this isn’t feasible, the next best thing is to stay on top of repairs and maintenance.

-

Avoid exiting your contract early - If you decide to exit your contract early (i.e. before you’ve paid off half of the total amount), you won’t necessarily be in negative equity, but you will end up paying more than necessary for the time you used the vehicle, as you’ll have to make up the shortfall to 50%.

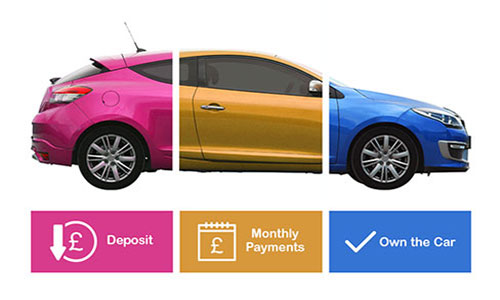

Can I sell a car with outstanding HP finance?

The lender is the legal owner of a car bought through a HP agreement until all payments have been made.

So, in order to sell a HP financed car, you’ll need to end the agreement early by getting a settlement quote. To get a finance settlement figure, you’ll need to contact the lender.

You should receive the finance settlement figure within a few working days - and you’ll then have a set period to pay the amount stated. Once the outstanding finance has been settled, you’re free to sell the car.

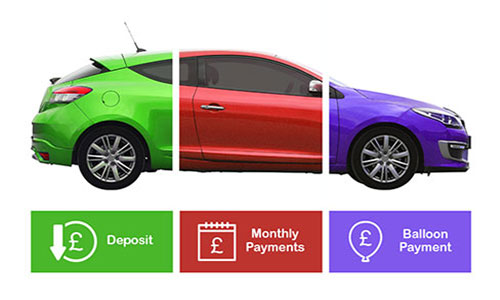

Can I sell a car with outstanding PCP finance?

Yes, you can sell a car on PCP finance, if you have made all repayments, including the final balloon payment – and any additional fees.

If you want to sell the car midway through your PCP agreement, you will need to pay off the agreement early, which may be worth doing if the finance settlement figure is lower than the value of the car.

Once the settlement figure has been paid, you will become the legal owner of the car, allowing you to sell your car.

Guaranteed minimum future value (GMFV) and balloon payments

A guaranteed minimum future value (GMFV) is an estimate of what a car will be worth at the end of a PCP contract’s term.

At the beginning of a PCP agreement, the lender will set a GMFV, which guarantees the car’s value at the end of the term, regardless of how much it truly depreciates. This can protect consumers from financial loss if a car depreciates more than expected, as the lender will absorb the risk.

A GMFV prevents you from losing money due to external factors such as market changes and unexpected depreciation.

At the end of the PCP agreement, you have the following options:

Pay the balance (i.e. the GFMV/balloon payment) to keep the car.

- Part-exchange your financed car.

- Hand the car back at no extra cost, even if its current market value is lower than the GMFV. You will still be liable for any mileage or damage-related penalties (if applicable).

- If you wish to sell a PCP finance car with outstanding finance, you’ll have the settle the balance first.

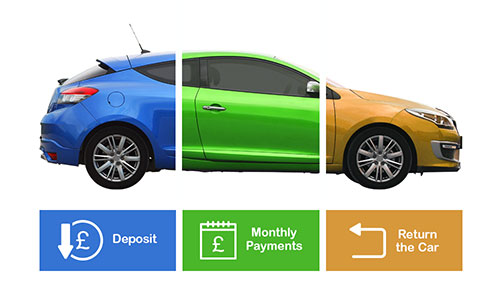

Can I sell a car with outstanding PCH finance?

If you have obtained a car through a Personal Contract Hire (PCH) or other lease agreement, you don’t have the option to buy the car as part of the agreement and cannot sell the vehicle. With PCH you are essentially renting a car for a period set out in the contract, meaning that the car is always owned by the finance company and must be returned to the lender at the end of the agreement. In some cases, you can request a figure to buy the car at the end of the agreement, but this is at the discretion of the finance company.

PCP vs. HP finance vs. personal loan: Key differences comparison

Personal loan |

HP |

PCP |

|

|---|---|---|---|

You’ll own the car from the start. |

✓ |

X |

X |

When can you sell the car? |

From the outset. |

When the outstanding finance is settled. |

When the outstanding finance is settled. |

Is there are an early settlement option? |

N/A |

✓ |

✓ |

Fixed monthly payments |

✓ |

✓ |

✓ |

Selling a car that was purchased with a personal loan

You can’t sell a car with PCP or HP finance until the balance is settled. However, if you’ve taken out a personal loan to purchase a vehicle, you’re free to sell it whenever you wish - providing you’ve paid for it in full.

Just bear in mind that you’ll still need to make the monthly repayments for the loan over the agreed duration.

Is it illegal to sell a car privately with outstanding finance?

Yes, it is illegal to sell a car with outstanding finance privately. Selling without informing the buyer of the vehicle’s outstanding finance status would constitute fraud.

Can I end my contract early then sell to webuyanycar?

It depends. Voluntary termination often results in you handing back the car rather than potentially cashing in on the vehicle’s positive equity.

Taking ownership of the vehicle is at the discretion of the finance company. However, if you are provided with a settlement letter confirming the amount to clear the interest on the vehicle - and the original V5C logbook, we will be able to purchase the vehicle from you.

Voluntary termination

Both HP and PCP finance contracts contain a ‘voluntary termination’ clause that allows you to return the car to the lender at no extra cost if you have paid at least half of the total amount owed.

If you’ve paid less than that, you can still return the car by making up the shortfall, so you’ve paid half the amount (including any interest or fees).

Voluntary termination is covered in Section 99 of the Consumer Credit Act 1974. Read our guide to cancelling your car finance early to learn more.

Voluntary termination vs. voluntary surrender

- If you choose to voluntarily terminate your car finance plan, you’ll be liable to pay half the total amount owed – along with any outstanding arrears.

- However, if you choose to voluntarily surrender your financed car, you’ll return the vehicle, but you’ll still be liable for the outstanding amount.

- Whilst the lender will attempt to recoup the outstanding balance by selling the car, you’ll still be liable to pay any remaining debt.

- It’s important to note that while a voluntary termination won’t impact your credit score, a voluntary surrender will appear on your credit report for six years after the first missed payment. This may make it harder to get approved for other car finance plans or loans in the future.

Can I part-exchange my car with outstanding finance?

Yes, you can part-exchange a car with outstanding finance. To do this, you must:

- Inform the finance company that you wish to sell the car and request a settlement figure.

- Approach the car dealer you wish to part-exchange with and ask how much they will offer you for the car.

- If you accept the dealer’s offer, the proceeds from the sale will go towards paying off the existing finance.

Can I scrap my financed car?

No, you cannot usually scrap a car with outstanding finance.

Even if your car is no longer roadworthy, it isn’t yours to sell. If you attempt to scrap a car that you don’t own, you could be charged with fraud – even if you intended to pay the balance with the money raised.

What can impact the valuation and price of my financed car?

Here are the key factors that can influence the value of your financed car:

-

Age - Cars lose value over time due to depreciation. New cars start to lose value as soon as they leave the forecourt. The steepest value loss usually occurs within the first year, then the rate of depreciation slows once cars reach ‘middle age’ around the 3–4-year mark.

-

Mileage: - If your car has a high mileage for its age, this can reduce its value. Conversely, if it has a relatively low mileage, you may get a higher valuation. However, it’s important to note that you can get a good price for a high mileage car that has been well cared for.

-

Condition - After several years on the road, a couple of minor scratches or imperfections are to be expected. However, more serious cosmetic and mechanical damage can significantly reduce your car’s value.

-

Documentation and accessories - If important documents such as the V5C logbook and service history - or accessories such as spare keys, or the locking wheel nut are missing, this can hurt your car’s value.

-

Market conditions - Market values for used cars constantly fluctuate due to supply and demand, regardless of other factors. If a particular make or model suffers a reputational hit, its used prices may also be affected.

-

Seasonality - The value of your car will also rise and fall at certain times of the year due to seasonal demand. For example, convertibles tend to sell for more during the spring and summer, when drivers can enjoy the ‘top down’ weather. Meanwhile, resale values for 4x4s, sports utility vehicles (SUVs) and multi-purpose vehicles (MPVs) peak during the colder months, as navigating cold, icy surfaces is their key strength.

-

Number plate changes - In early March and September each year, new number plates are released and assigned to brand-new cars. When this happens, the cars that no longer hold the latest plates will lose value. However, the older a car is, the less it will be impacted by a plate change.

-

Outstanding finance - Finally, the amount you owe the lender for your financed car is also an important consideration, as this will determine how much cash you get when you sell it. If you’ve paid off the full amount, or financed the car using another method, such as a bank loan, you’ll be free to spend the proceeds as you wish.

How to sell your financed car with webuyanycar

-

webuyanycar can buy your HP or PCP financed car.

-

To sell your financed car to us, you’ll just need to provide us with an in-date settlement letter from the lender.

-

Lenders are legally required to post a settlement figure to you within 12 days of your request - although the process is usually much quicker.

-

Once you receive it, enter your reg number, mileage, and other key details into our free car valuation tool to get a quote in under 30 seconds.

-

Make an appointment at any of our 500+ UK branches at a convenient time and date.

-

Remember to bring your settlement letter to your appointment.

-

The buyer can settle the outstanding finance on your behalf.

-

If you are in negative equity, we can even make up the shortfall, providing you advance us with the exact amount needed to make up the balance.

We’re rated ‘Excellent’ on Trustpilot

Frequently asked questions

All you have to do is get in touch with your finance company and ask them for a “settlement figure”.

By law your lender has to post a settlement figure to you within 12 days – most times it comes straight away.

You will have a period – usually 10 days – in which to actually pay the amount off. If you pay by Direct Debit (DD), check the day it normally comes out of your bank – if they receive this amount before you settle the finance then you’ll need to take the DD amount off the amount you pay. You will need to provide evidence of payment to us if this is the case.

Yes, you should be able settle off a PCP agreement or terminate it by paying off the settlement figure. Again, read your finance agreement carefully for your exact terms.

In order to settle your finance you’ll find the finance company’s address on the agreement you signed.

Don't forget, with a HP or PCP agreement you have to settle the finance on the car or terminate the agreement by paying off money owing before you can sell the car on to webuyanycar (or anyone else) although this can happen virtually at the same time but in that order.

Please remember that you have to get a finance settlement figure in order to sell your car to webuyanycar. We facilitate the payment to your finance company for your agreement.

Yes, this is technically possible. However, if your financed car is in negative equity and you want to part-exchange it, you’ll need to pay the difference, along with the deposit for your next vehicle.

Yes, many dealers and car buying services can settle any outstanding finance. Whether you intend to pay the finance settlement figure yourself or want the dealer to do so, you’ll need to notify the lender that you wish to sell the car.

Your options for clearing negative equity include making additional payments, refinancing the loan, and renegotiating the terms with the lender.

If you can afford to do so, paying off your finance early can be cheaper than continuing to make your regular payments, particularly if interest rates increase.

Yes, you have the option to return a financed car at the end of a PCP agreement, if you decide not to make the balloon payment. You can also return your car during a PCP or HP agreement through voluntary surrender or voluntary termination.