- In 2024, used car market transactions grew by 5.5% , with a total of 7,643,180 cars changing hands.

- The UK’s new car market recorded a second consecutive year of growth, with 1,952,778 new cars joining the road – marking a 2.6% rise from the previous year.

Whether you’re a journalist, consumer, or industry professional, making sense of the latest car market trends will help you make sound decisions.

Our guide rounds up the latest sales data, statistics, and insights from across the UK’s new and used car markets. We’ve added fresh commentary to help you interpret the details that matter.

We’ll bring you up to date with key market developments from Q4 2024, including the best-selling new and used car models, market share by powertrain, and the latest Government initiatives driving electrification.

Finally, our expert forecasts will help you build an early picture of where the new and used car markets are headed in early 2025 and beyond.

Quick links:

-

Quick links:

Key used car sales statistics 2024|

- UK’s best-selling new car in 2024

|

- New UK car market statistics 2024

|

- New car market statistics January 2025

|

- Early new car market forecast for 2025

|

- Historic used car sales statistics

|

- How many cars are there in the UK?

|

- UK used car sales by powertrain

|

- Bestselling used car models

|

- Historic new car sales statistics

|

Get a free valuation

Key used car sales statistics 2024

| Q4 2024 | Q4 2023 | % change | 2024 total | 2023 total | % change | |

|---|---|---|---|---|---|---|

| Used car transactions | 1,746,051 | 1,679,116 | 4.0% | 7,643,180 | 7,242,692 | 5.5% |

Source: SMMT

- The UK’s car market has reported eight consecutive quarters of growth (throughout 2023 and 2024).

- Supermini was the most popular body type with a 32.3% market share, followed by lower medium (21.7%) and dual purpose (15.9%), leaving the top three spots unchanged from 2023.

- In Q4 2024, 1,746,051 used cars were sold, marking a 4% YoY increase.

- 2024 was a record year for used battery electric vehicle (BEV) sales, with 188,382 units sold, achieving a 2.5% market share.

- INDICATA’s monthly Market Watch report revealed that the UK’s retailed used BEV sector is the most stable of the 13 major European countries.

- However, petrol and diesel were the most popular powertrains for used car buyers in 2024, with 4,367,009 and 2,674,725 transactions respectively.

- In 2024, black was the most popular colour among used car buyers with a 21.3% market share, followed by grey (17.6%), and blue (16.2%).

- The Ford Fiesta was the best-selling used car model in Q4 and throughout the year with 70,249 transactions in total.

- SMMT data indicates that the Fiesta has been the UK’s top selling used car model since at least 2016!

Source: SMMT, INDICATA

Used car market commentary

Mike Hawes, the SMMT’s chief executive, said,

Record sales of second hand EVs also demonstrates strong appetite for these cutting-edge cars at lower price points.

Ensuring ongoing growth, however, means maintaining that affordability, along with supply, which requires meaningful fiscal incentives to stimulate consumer demand for new EVs and removing the VED expensive car tax disincentive that risks dragging down used EV affordability for years to come.

Richard Evans, webuyanycar’s head of technical services said:

The UK’s used car market saw impressive growth in 2024, driven by consumer demand and increased stock from the new car sector.

For many used car sellers, now is a great time to trade in, as robust demand keeps prices competitive.

Source: SMMT, webuyanycar

Used car market predictions for 2025 and beyond

- Data firm Cox Automotive predicts that the UK’s used car market will see ‘modest’ growth over the coming years.

- Their forecast anticipates that annual used car transactions will grow from 7.4 million in 2024 to almost 7.9 million by 2027.

- According to a new report by Research and Markets, the UK’s used car market is on an ‘unequivocal upward trajectory’.

- This report indicates that the market will surge by £28.2 billion between 2023 and 2028, with a compound annual growth rate (CAGR) of 5.97%.

Source: Cox Automotive, Research and Markets

What was the UK’s best-selling new car in 2024?

In 2024, the Ford Puma was the UK’s best-selling new car, with 48,340 units sold. The popular small SUV topped the list for the second year in a row – narrowly beating the Kia Sportage, which sold 47,163 units throughout 2024.

Source: SMMT

New car market statistics 2024

| Powertrain | 2024 | 2023 | Change | Market share ‘24 | Market share ‘23 |

|---|---|---|---|---|---|

| Diesel | 123,104 | 142,434 | -13.6% | 6.3% | 7.5% |

| Petrol | 1,019,128 | 1,066,211 | -4.4% | 52.2% | 56.0% |

| BEV | 381,970 | 314,687 | 21.4% | 19.6% | 16.5% |

| PHEV | 167,178 | 141,311 | 18.3% | 8.6% | 7.4% |

| HEV | 261,398 | 238,411 | 9.6% | 13.4% | 12.5% |

| Total | 1,952,778 | 1,903,054 | 2.6% |

Source: SMMT

- Market growth was delivered by fleet registrations, which rose 11.8% to a total of 1,163,855 units – accounting for almost 60% of registrations.

- Meanwhile, private registrations fell by 8.7% to 746,276 and the SMMT noted that ‘lacklustre demand by private buyers’ was a constraint to growth.

- Only 1 in 10 private buyers opted for a BEV.

- However, BEVs accounted for over 25% of new car registrations in November.

- BEVs achieved a 19.6% market share in 2024.

- The Government’s zero emission vehicle (ZEV) target for 2025 mandated that 22% of all vehicles sold by manufacturers must be fully electric.

- Manufacturers missed the headline target of 22%, but the 19.6% achieved surpassed the 18% needed for compliance, considering the flexibilities that were lobbied in by the automotive industry.

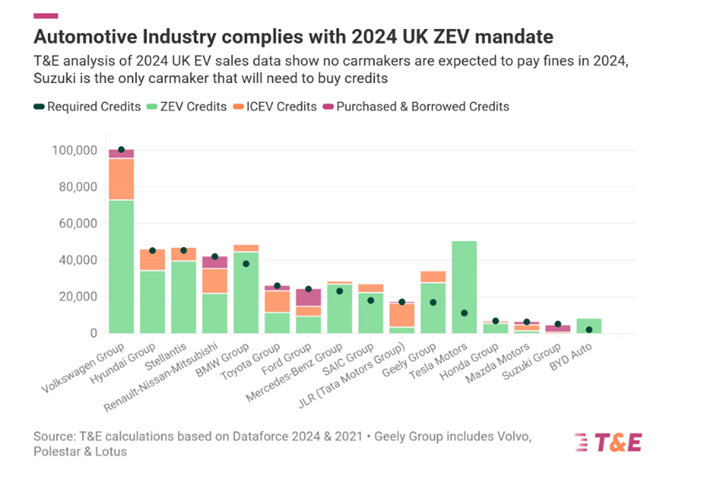

- At an individual level, all major car manufacturers met the 2024 targets – and only Suzuki will need to purchase credits to achieve compliance (due to no fully electric sales in the UK over 2024).

Graph courtesy of Transport & Environment

Source: SMMT, This is Money, Transport and Environment

New car market statistics January 2025

SMMT new car registration data from January 2025:

| Powertrain | 2025 | 2024 | Change | Market share ‘25 | Market share ‘24 |

|---|---|---|---|---|---|

| Diesel | 8,625 | 9,348 | -7.7% | 6.2% | 6.5% |

| Petrol | 70,075 | 82,753 | -15.3% | 50.3% | 57.9% |

| BEV | 29,634 | 20,935 | 41.6% | 21.3% | 14.7% |

| PHEV | 12,598 | 11,944 | 5.5% | 9.0% | 8.4% |

| HEV | 18,413 | 17,896 | 2.9% | 13.2% | 12.5% |

| Total | 139,345 | 142,876 | -2.5% |

webuyanycar's head of technical services Richard Evans said,

January’s data demonstrates a continued shift in car buyers’ priorities.

BEVs are gaining traction thanks to improved consumer confidence and a wider choice of dependable models. HEVs and PHEVs are also gaining popularity, as they strike a good balance between efficiency and affordability.

Although market activity has dipped slightly compared to last year, the appetite for low-emission vehicles has not weakened.”

Early new car market forecast for 2025 and beyond

The SMMT’s January 2025 outlook projects that 1.949 million new cars will be registered throughout the year – a slight downgrade from the 1.977 million predicted last November.

Here are the key takeaways from the forecast:

- BEV registrations are projected to rise 21.4%, achieving a 23.7% market share.

- PHEV registrations are expected to grow 18.4%, bringing market share to 10.2%.

- HEV registrations are projected to rise 10%, with market share reaching 14.7%.

- Diesel registrations are expected to fall 17%, reducing market share to 5.2%.

- Petrol registrations are expected to decline 11.7%, bringing market share down to 46.2%.

- The outlook also predicts that in 2026, the car market will surpass 2 million units for the first time since 2019.

webuyanycar’s head of technical services Richard Evans said,

The SMMT’s projected volumes indicate a resilient, steadily growing new car market. Plug-in cars are expected to take over a third of the market share in 2026, which signals a clear growth in appetite for sustainable motoring.

Manufacturers are quickly diversifying their electric offerings to meet the Government’s increasingly ambitious ZEV mandate targets. As a result, new and used buyers alike will benefit from a larger choice of increasingly affordable BEVs, made more accessible by an ever-growing public charger network.

Buyers will find plenty of reliable, traditionally fuelled vehicles at attractive prices. However, when it comes to resale value, BEVs are the clear winner. So, if you plan to sell your next car a few years down the line, now could be the right time to make the switch to a BEV.”

How many cars are there in the UK?

According to DVLA data, as of June 2024 there were approximately 33,936,000 UK-registered cars.

UK used car sales statistics (2024-2014)

| Year | Number of used car sales |

|---|---|

| 2024 | 7,643,180 |

| 2023 | 7,242,692 |

| 2022 | 6,890,777 |

| 2021 | 7,530,956 |

| 2020 | 6,752,959 |

| 2019 | 7,935,105 |

| 2018 | 7,945,040 |

| 2017 | 8,113,020 |

| 2016 | 8,200,000 |

| 2015 | 7,640,015 |

| 2014 | 7,433,129 |

Source: SMMT

UK used car sales by powertrain (2023-2024)

| Powertrain type | 2024 | 2023 | YoY % change |

|---|---|---|---|

| Petrol | 4,367,009 | 4,079,555 | +7.05% |

| Diesel | 2,674,725 | 2,747,911 | -2.66% |

| HEV | 306,114 | 221,859 | +37.98% |

| BEV | 118,382 | 118,973 | -0.50% |

| PHEV | 92,120 | 65,837 | +39.92% |

Source: SMMT

Bestselling used car models (2023-2024)

webuyanycar’s head of technical services, Richard Evans said:

The Ford Fiesta has kept its crown as the UK’s best-selling used car for yet another year, showcasing its enduring popularity, despite being discontinued in 2023!

At the same time, Vauxhall’s Corsa has strengthened its position while sales for other consumer favourites such as the Volkswagen Golf, MINI, and Ford Focus held steady.”

| 2024 Transactions | 2023 Transactions |

|---|---|

| Ford Fiesta (306,207) | Ford Fiesta (308,017) |

| Vauxhall Corsa (252,761) | Vauxhall Corsa (237,705) |

| Volkswagen Golf (231,440) | Volkswagen Golf (227,427) |

| Ford Focus (228,220) | Ford Focus (223,417) |

| MINI (160,516) | Vauxhall Astra (160,736) |

| Vauxhall Astra (159,495) | MINI (158,298) |

| BMW 3 Series (158,674) | BMW 3 Series (155,100) |

| Volkswagen Polo (151,786) | Volkswagen Polo (141,135) |

| Nissan Qashqai (138,810) | Nissan Qashqai (120,286) |

| BMW 1 Series (125,440) | Audi A3 (118,805) |

webuyanycar’s head of technical services, Richard Evans said:

The Ford Fiesta has kept its crown as the UK’s best-selling used car for yet another year, showcasing its enduring popularity, despite being discontinued in 2023!

At the same time, Vauxhall’s Corsa has strengthened its position while sales for other consumer favourites such as the Volkswagen Golf, MINI, and Ford Focus held steady.

UK new car sales statistics (2024-2011)

| Year | Number of Registrations |

|---|---|

| 2024 | 1,952,778 |

| 2023 | 1,903,054 |

| 2022 | 1,614,063 |

| 2021 | 1,647,181 |

| 2020 | 1,632,064 |

| 2019 | 2,311,140 |

| 2018 | 2,367,147 |

| 2017 | 2,540,617 |

| 2016 | 2,692,786 |

| 2015 | 2,633,503 |

| 2014 | 2,476,435 |

| 2013 | 2,264,737 |

| 2012 | 2,044,609 |

| 2011 | 1,941,253 |

Source: SMMT